As widely announced in recent months , Apple has introduced Apple Card, the credit card that is going to expand the already widespread Apple Pay service, one of the most secure methods to make payments that, by this year, will be available in more than 40 countries.

Created in collaboration with Goldman Sachs and Mastercard, Apple Card is a new credit card created for iPhone that allows you to do many more things than other cards. It is created directly from the iPhone in a few minutes and works all over the world, where Apple Pay is accepted. Once created, the card will probably be delivered at home. It will not be in plastic but in titanium.

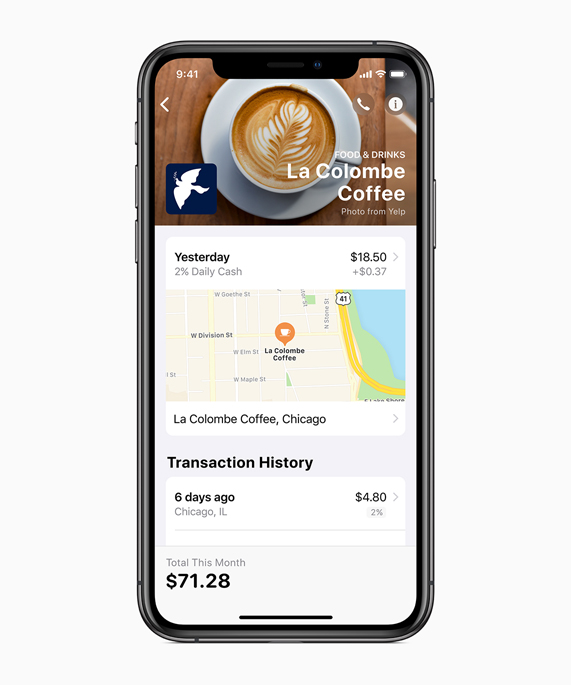

Available in the US this summer, Apple Card also offers a clearer and more compelling rewards program than other credit cards with Daily Cash, which returns a percentage of every cash purchase each day on customers’ Apple Cash card.

“Apple Card is based on the huge success of Apple Pay and offers new experiences only with the power of the iPhone,” said Jennifer Bailey, Apple Pay vice president of Apple. “Apple Card is designed to help customers lead a healthier financial life, which starts with a better understanding of their expenses so they can make smarter choices with their money.”

A credit card designed for iPhone

Customers can sign up for Apple Card in the Wallet app on their iPhone in minutes and start using it with Apple Pay in stores, apps or online around the world. Apple Card offers customers real-time visions easy to understand and in real time the latest transactions and the Wallet balance, Apple Card support is available 24 hours a day, 7 days a week, simply by sending a message from Messages.

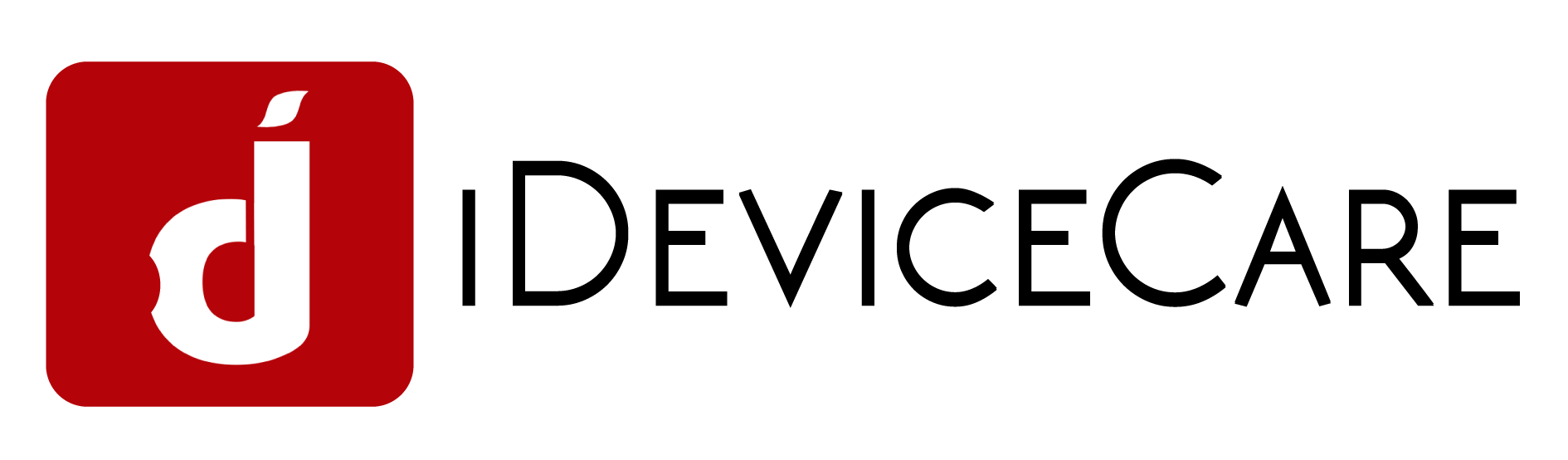

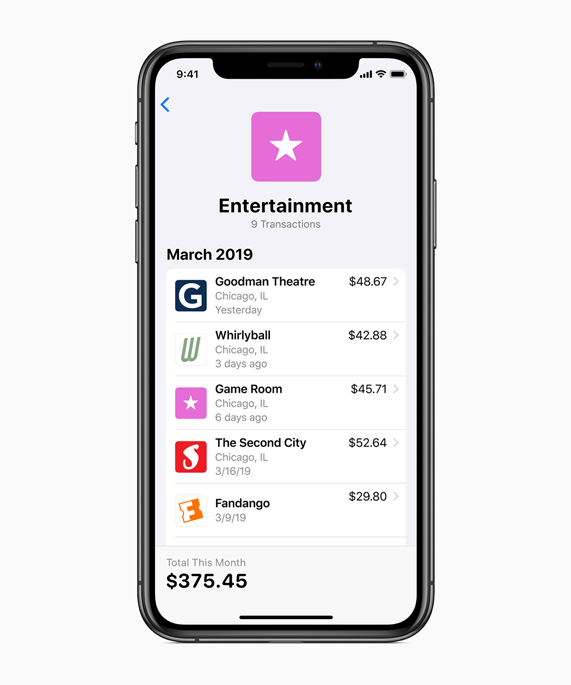

Easy to understand expenditure

Apple Card uses machine learning and Apple Maps to clearly label transactions with names and commercial locations. Purchases are automatically added up and organised into categories with different colors such as food and drinks, shopping and entertainment. To help customers better understand their expenses, Apple Card provides weekly and monthly shopping summaries.

Receive daily cash

Whenever customers use Apple Cards with Apple Pay, they will receive 2% cash back and 3% cash back on all purchases made directly with Apple, even at Apple Store, on the App Store and for Apple services.

No cost and interest

There are no fees associated with Apple Card: no annual, late, international or over-the-limit fees. The goal of Apple Card is to provide interest rates among the lowest in the industry and if a customer misses a payment, no penalty rate will be charged.

Recent Comments