Apple Card, the Apple-branded credit card that is being launched in collaboration with Goldman Sachs, is available for all customers in the United States starting today after a preview period launched a few weeks ago for some users.

Potential customers can request an Apple Card using the Wallet app and, after approval, they can immediately start using the digital part of the card for online purchases and with Apple Pay.

The availability of the Apple Card is subject to approval and customers must qualify similarly to any other credit card. Apple Card offers an APR (The APR is the annual interest rate you pay on your credit card) between 12.99 and 23.99% based on your credit score.

Apple will ship a physical titanium credit card to Apple Card users within a few days, providing a real card for traditional credit card purchases. The titanium card is engraved with the name of the holder but does not have a card number, expiration date or CVV for privacy reasons.

This information is still available but can be accessed via the Wallet app. The paper is characterized by a traditional pinstripe together with an integrated chip to make purchases inside the shops.

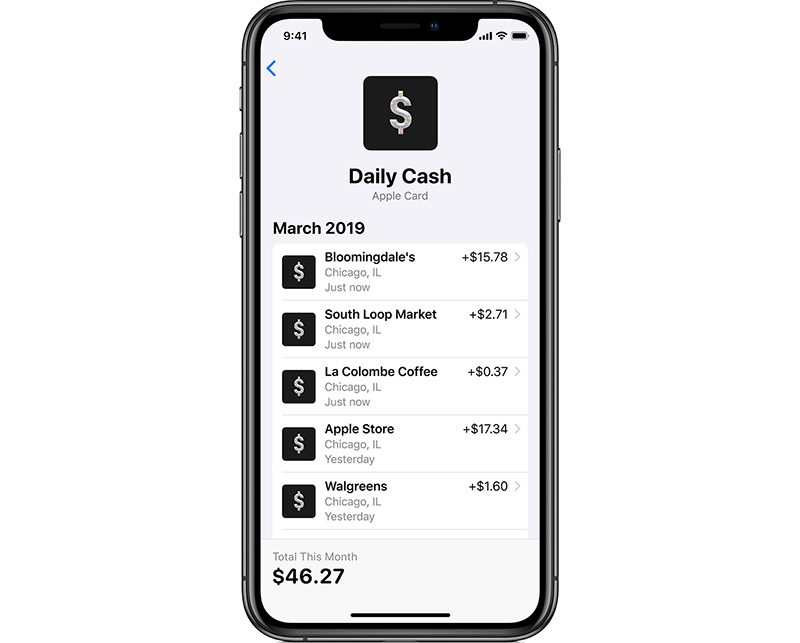

The Apple Card can be used for both standard purchases and for Apple Pay purchases, with Apple offering rewards for both. Customers will receive a 3% refund for purchases made at an Apple Store, a 2% refund for all Apple Pay purchases and a 1% refund for all other purchases.

The refund is provided in the form of ” Daily Cash ” which, as the name suggests, is paid to customers on a daily basis. The daily cash is added to the Apple Cash card in Wallet and can be used for purchases, sent to friends or transferred to a bank account.

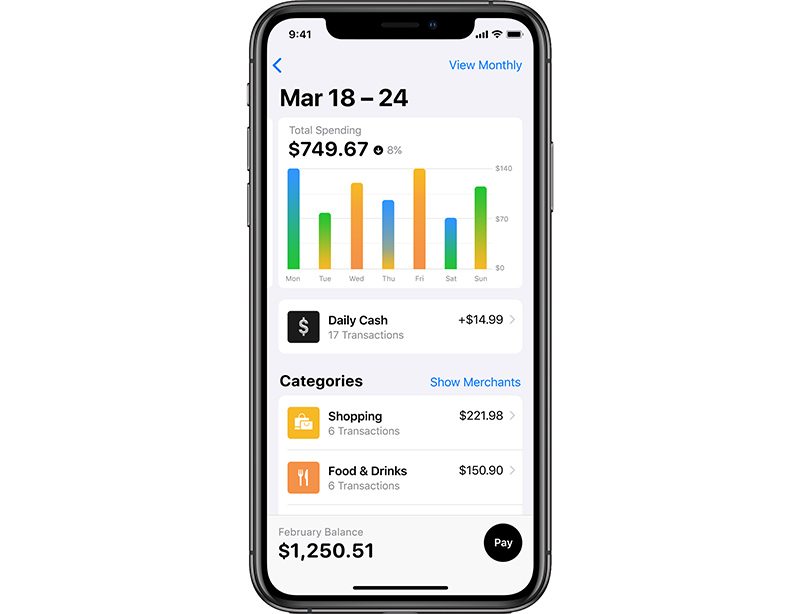

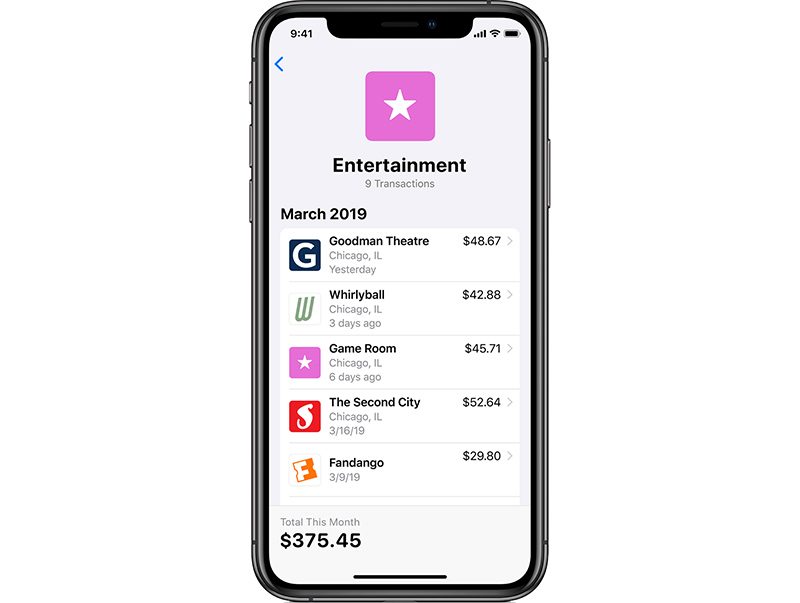

The Apple Card is deeply integrated into the Wallet app and Apple offers spending tracking and budget tools. The colour-coded categories will give users an idea of how much money they spend on food, activities, shopping, health care, entertainment and more.

Apple will send notifications whenever a purchase is made so that users can monitor fraudulent activity and Apple uses machine learning and Maps to make sure that every single transaction made is clearly identified.

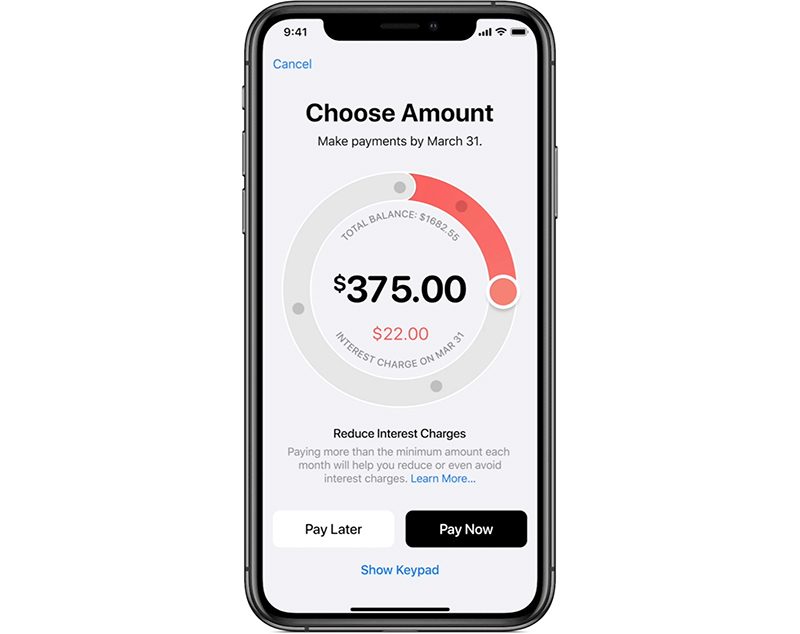

The Wallet app also helps with payments, offering multiple payment options and ways to minimize interest through higher and regular payments. The Apple Card will encourage customers to pay a little more than the minimum each month to reduce interest. Payments can be scheduled weekly, twice a week and monthly and can be made using a bank account like any other credit card.

At the moment, the Apple Card is limited to the United States but could expand to other countries in the near future. Apple is already in talks with European regulators and has registered the Apple Card in Europe, Hong Kong and Canada.

Recent Comments